El Bitcoin no fue minado con antelación, lo que significa que no se han extraído ni distribuido monedas entre los fundadores antes de que estuvieran disponibles para el público. Sin embargo, durante los primeros años de existencia de BTC, la competencia entre los mineros era relativamente baja, permitiendo a los primeros participantes de la red acumular cantidades significativas de monedas a través de la minería regular. https://test.com/ Se cree que Satoshi Nakamoto solo posee más de un millón de Bitcoins.

También es importante hacer una copia de seguridad del archivo wallet.dat o exportar la clave correspondiente o frase semilla, que será necesaria para recuperar tus fondos en caso de que tenga problemas con tu computadora en el futuro.

Por esta razón, los usuarios que buscan almacenar de forma segura sus criptomonedas durante un largo tiempo (HODLers) a menudo usan una billetera de hardware, que es “fría” ya que no está conectada a Internet, y eso les ofrece una alternativa más segura.

Una billetera de escritorio es diferente a una billetera web ya que depende del software que un usuario descarga, y opera localmente en su computadora. Las carteras de escritorio ofrecen a los usuarios un control total sobre sus claves, que se almacenan como un archivo wallet.dat.

Cryptocurrency wallets

Coinomi is a desktop and mobile wallet that supports over 1,770 coins and tokens on 125 different blockchains. This impressive range puts Coinomi far ahead of most wallets on the market and makes it our pick for the best multi-crypto wallet.

Not only does the Coinbase Wallet Web3 seamlessly connect to its native crypto exchange, but it also works with major decentralized crypto exchanges (DEXes) such as Uniswap (UNI), Sushiswap (SUSHI), 1inch (1INCH) and TraderJoe, among others.

Een andere topper van de beste crypto wallets is die van Exodus. Het platform biedt een wallet met vrijwel alle Web3 functies die je maar kunt bedenken. Zo kun je gebruik maken van Apps, cross-chain token swaps, crypto staking en natuurlijk het opslaan van tokens en NFT’s.

Met Best Wallet vindt je, net als crypto platforms zoals DEXTools, binnenkort de beste trending crypto, daily gainers en veelbelovende cryptomunten. Uiteraard is Best Wallet ook ideaal voor het veilig opslaan van je Bitcoin en populaire altcoins.

Ledger staat bekend om het leveren van de beste hardware wallet crypto apparaten, die vrijwel immuun zijn tegen hackers. Om tokens van of naar je Ledger te verplaatsen, moet je een PIN-code invoeren en natuurlijk heb je de hardware wallet zelf nodig. Hierdoor kan niemand die jouw wallet steelt, toegang krijgen tot jouw crypto assets zonder deze PIN-code.

Cryptocurrencies

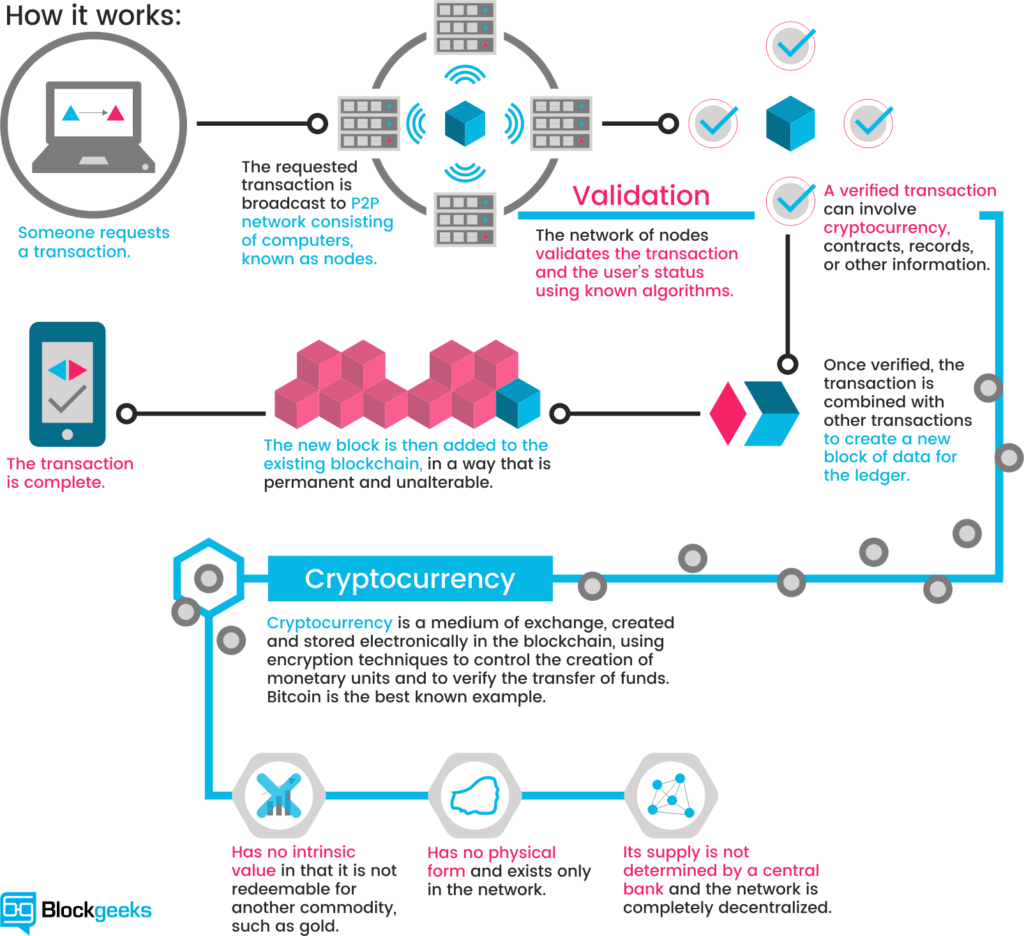

Cryptocurrencies are digital currencies which owe their credibility to their technology rather than a central bank. Many of the transactions in this statistic involve cryptocurrency exchanges which exchange these coins for other currencies, including traditional currencies such as U.S. dollars or euros. In selected countries, Bitcoin ATMs also dispense the local currency in exchange for Bitcoin. However, few retailers accept that or any other cryptocurrency on a large scale.

Currently, the cryptocurrency market has been experiencing a period of volatility, with fluctuations in the value of major cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. The market has also seen a rise in the number of altcoins, or alternative cryptocurrencies, with unique features and use cases.Several growth factors are driving the growth of the cryptocurrency market, including increasing acceptance and adoption of cryptocurrencies by individuals and institutions, growing interest in decentralized finance (DeFi) platforms, and the potential for cryptocurrencies to serve as a hedge against inflation and political instability. Additionally, advancements in blockchain technology and the increasing use of cryptocurrencies for cross-border transactions are also contributing to market growth.The cryptocurrency market is expected to continue growing in the coming years. The increasing adoption of cryptocurrencies by businesses and individuals, along with the ongoing development of DeFi and other blockchain-based platforms, is likely to fuel this growth. However, the market is also likely to experience volatility and corrections, as is typical with any emerging and rapidly evolving market.

Many cryptocurrency enthusiasts point to the high market capitalization of their favorite cryptocurrencies. Also, the currency price is an important factor. The price volatility of Bitcoin and others attracts investors, hoping to buy low and sell high.

Any private individual or company that knows how to write a program on a blockchain can technically create a cryptocurrency. That blockchain can be an existing one. Ethereum and Binance Smart Chain are popular blockchain platforms for such ends, including smart contracts within Decentralized Finance (DeFi). The ease of crypto creation allows some individuals to find solutions to real-world payment problems while others hope to make a quick profit. This explains why some crypto lack utility. Meme coins such as Dogecoin – named after a Japanese dog species – are an infamous example, with Dogecoin’s creator coming out and stating the coin started as a joke.

Cryptocurrencies are digital currencies which owe their credibility to their technology rather than a central bank. Many of the transactions in this statistic involve cryptocurrency exchanges which exchange these coins for other currencies, including traditional currencies such as U.S. dollars or euros. In selected countries, Bitcoin ATMs also dispense the local currency in exchange for Bitcoin. However, few retailers accept that or any other cryptocurrency on a large scale.

Currently, the cryptocurrency market has been experiencing a period of volatility, with fluctuations in the value of major cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. The market has also seen a rise in the number of altcoins, or alternative cryptocurrencies, with unique features and use cases.Several growth factors are driving the growth of the cryptocurrency market, including increasing acceptance and adoption of cryptocurrencies by individuals and institutions, growing interest in decentralized finance (DeFi) platforms, and the potential for cryptocurrencies to serve as a hedge against inflation and political instability. Additionally, advancements in blockchain technology and the increasing use of cryptocurrencies for cross-border transactions are also contributing to market growth.The cryptocurrency market is expected to continue growing in the coming years. The increasing adoption of cryptocurrencies by businesses and individuals, along with the ongoing development of DeFi and other blockchain-based platforms, is likely to fuel this growth. However, the market is also likely to experience volatility and corrections, as is typical with any emerging and rapidly evolving market.

Cryptocurrency exchange

Upbit – Upbit is basically -the- exchange in South Korea, and largely unused elsewhere. It’s mostly notable in that its markets tends to move a bit unpredictably compared to the rest of the world at times.

Like most other exchanges on this list, Coinsmart Exchange is also regulated by and fully compliant as a Money Service Business with FINTRAC. They support a range of payment methods for funding your account including bank draft, credit and debit cards, wire transfers and Interac eTransfers. You can also take advantage of same-day funding, making it ideal for anybody who wants to get started with trading straight away.

I was originally going to include these in the list, but the volume on even Uniswap was surprisingly low enough to not make the cut. The general structure for these is all the same, however. Connect your wallet to the app, and trade from there. You’ll have to pay network fees ontop of exchange fees though, which messes with the cost valuation a bit, and generally makes all of them significantly worse fees than the centralized exchanges.

First of all: Don’t use Coinbase Basic. The fees on it are exorbitant, and it just goes through the same market under the covers as the (free) Coinbase Pro. You can also swap assets between the two instantly for free at any time, so for the sake of this post I’m considering the best of both options.

Additionally, you’ll be taking any passive income, security, and other considerations into your own hands with DeFi exchanges, so the only things to consider for DeFi is the trading fee, network transaction fee, and coin availability. But since there’s no lockup, fiat onramps, or anything else to consider, you can just choose whichever DeFi exchange happens to offer the coin you want at the time, and change easily between transactions.